steamboat springs colorado sales tax rate

- The Income Tax Rate for Steamboat Springs is 46. 38 higher compared to the March 2021 collections or an increase of 1 221 108.

Colorado Sales Tax Rates By City County 2022

Steamboat Springs is located within Routt County Colorado.

. The Colorado Springs sales tax rate is. The average cumulative sales tax rate in Steamboat Springs Colorado is 84. 800 am - 500 pm.

Lessors Anyone renting or leasing tangible personal property. Steamboat Springs CO 80487. For the past 5 years March collections represent about 11 of annual collections.

The Colorado sales tax rate is currently. The County sales tax rate is. Colorado Sales and Use Tax Forms.

Who Needs a Sales Tax License. View more property details sales history and Zestimate data on Zillow. What is the sales tax rate in Steamboat Springs Colorado.

Stratmoor CO Sales Tax Rate. Stonewall Gap CO Sales Tax Rate. 6 rows The Steamboat Springs Colorado sales tax is 290 the same as the Colorado state.

The County sales tax rate is. PART II - STEAMBOAT SPRINGS REVISED MUNICIPAL CODE Chapter 22 - TAXATION Steamboat Springs Colorado Code of Ordinances Page 1 of 128 STEAMBOAT SPRINGS SALES AND USE TAX TABLE OF CONTENTS TAXATION SECTION PAGE ARTICLE I. Steamboat Springs in Colorado has a tax rate of 84 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Steamboat Springs totaling 55.

Chaser within the City limits. View details map and photos of this single family property with 3 bedrooms and 4 total baths. The Colorado sales tax rate is currently 29.

Buyer and seller both in Hayden. Effective January 1 2016 through December 31 2020 the City of Colorado Springs sales and use tax rate is 312 for all transactions occurring during this date range. 2 State Sales tax is 290.

Home is a 3 bed 10 bath property. Sales and use tax. The minimum combined 2022 sales tax rate for Steamboat Springs Colorado is.

Did South Dakota v. Did South Dakota v. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

Strasburg CO Sales Tax Rate. 010 Trails Open Space and Parks TOPS. You can find more tax rates and allowances for Steamboat Springs and.

Stonington CO Sales Tax Rate. This is the total of state county and city sales tax rates. None if net taxable sales are greater than 100000000.

The combined amount was 825 broken out as followed. The March 2022 sales taxes for the City of Steamboat Springs are 34. ENTERPRISE ZONES Reserved ARTICLE III.

Tax Jurisdiction Tax Rate State of Colorado 29 Routt County 10 City of Steamboat Springs 45 Total combined sales tax rate inside the City 84 Documentation provided outside City no permits or certificates 84 39 County building permits 74 29 City building permits 29 29 sales tax licenses 00 00 exemption certificates 00 00. Income and Salaries for Steamboat Springs. This is the total of state county and city sales tax rates.

The County sales tax rate is 1. The US average is 28555 a year. The Steamboat Springs sales tax rate is.

The minimum combined 2022 sales tax rate for Steamboat Colorado is 39. 4 rows The 84 sales tax rate in Steamboat Springs consists of 29 Colorado state sales. Stoneham CO Sales Tax Rate.

312 City of Colorado Springs self-collected 200 General Fund. Free Unlimited Searches Try Now. Retailers Anyone engaged in the business of making retail sales.

- Tax Rates can have a big impact when Comparing Cost of Living. Free automated sales tax filing for small businesses for up to 60 days. Calculate rates Calculate rates Menu.

Live in Routt County. Live in Steamboat Springs. Buyer and seller both in Oak Creek.

The Colorado sales tax rate is currently. Sterling CO Sales Tax Rate. Listed by Colorado For Sale By Owner Services.

Rates are per room per night and based on. Stonegate CO Sales Tax Rate. Sales Tax and Use Tax Rate of Zip Code 80477 is located in Steamboat springs City Routt County Colorado State.

10 rows The City of Steamboat Springs is a home rule municipality with its own Municipal Code. Did South Dakota v. The US average is 46.

Building Use Tax If you have Building Use Tax questions please. - The average income of a Steamboat Springs resident is 36767 a year. 1063 13th St Steamboat Springs CO 80487-4914 is a single-family home listed for-sale at 1035000.

What is the sales tax rate in Steamboat Colorado. 88 more than year to date through the same period last year. Limited number of rooms are available for this promotion.

2200 Village Inn Court Steamboat Springs Colorado 80487 USA 1 970-879-2220. Ad Get Colorado Tax Rate By Zip. For Sale - 311 Pearl St Steamboat Springs CO - 2175000.

The Steamboat Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Steamboat Springs Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Steamboat Springs Colorado. Steamboat Springs CO Sales Tax Rate. IN GENERAL Reserved ARTICLE II.

The Steamboat sales tax rate is 0. The US average is 73. The Steamboat Springs sales tax rate is 45 Steamboat Springs accommo-dations tax rate is 1 of the retail purchase price.

This is the total of state county and city sales tax rates. Dates and is only valid through the stay window end date. Year - to - date sales tax collection is 35.

This includes the sales tax rates on the state county city and special levels. No credit card required. Starkville CO Sales Tax Rate.

Tax Rates City Sales Tax 40 School Tax 05 City of Steamboat Springs REMIT TO CITY 45 City Accommodations REMIT TO CITY 10 State of Colorado REMIT TO STATE 29 Routt County REMIT TO STATE 10 Total Combined Tax Rate 94 LMD Accommodations Tax REMIT TO STATE 20. The sales tax rate does. Within Steamboat Springs there are around 2 zip codes with the most populous zip code being 80487.

Colorado Sales Tax Rates By City

Denver Gop Chair Seeks Limit On Taxation Ballot Measure Proposes Cap On City Sales Tax Rate Complete Colorado Page Two

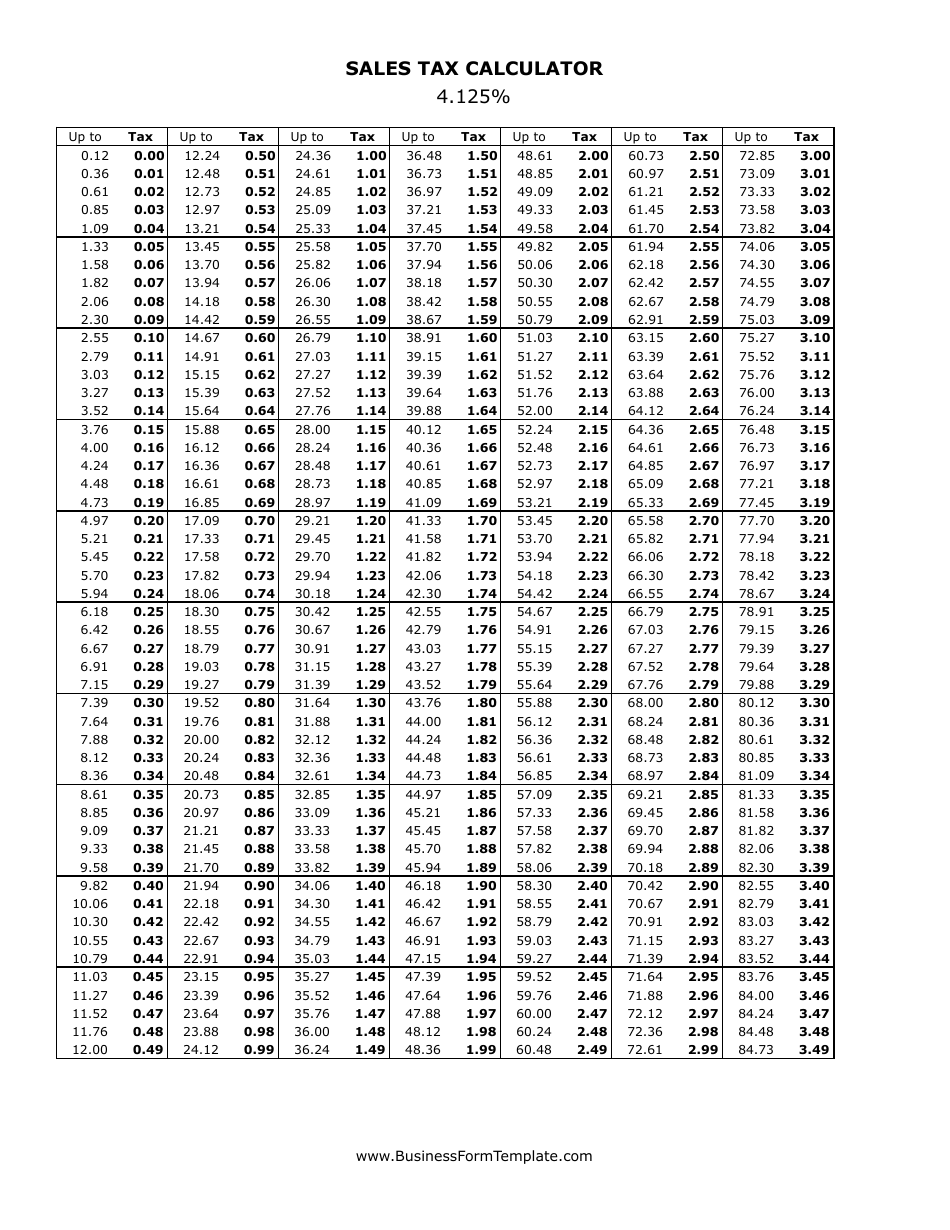

4 125 Sales Tax Calculator Download Printable Pdf Templateroller

How S The Market Town Is Buzzing Real Estate Marketing Marketing How To Plan

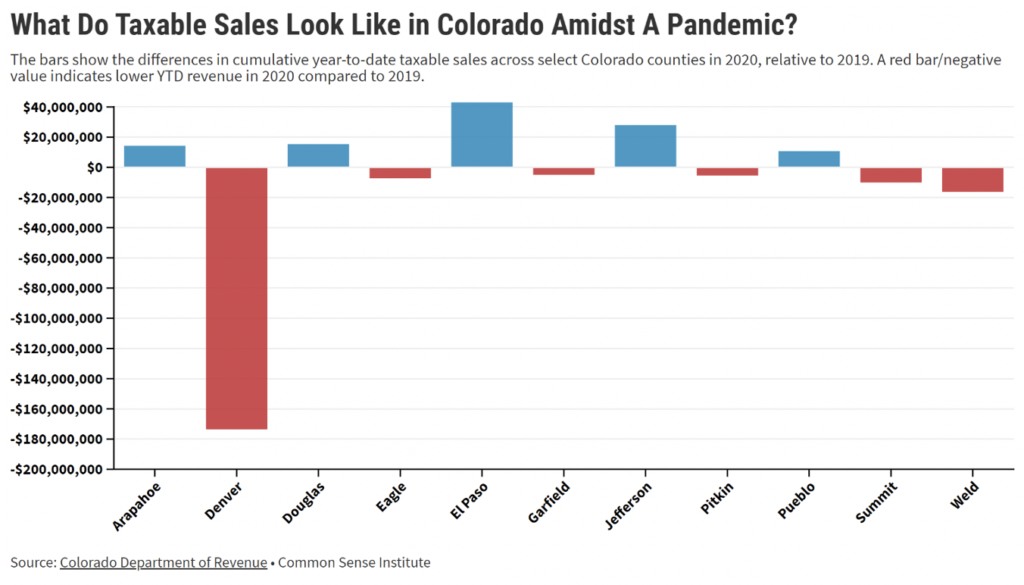

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

File Sales Tax Online Department Of Revenue Taxation

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

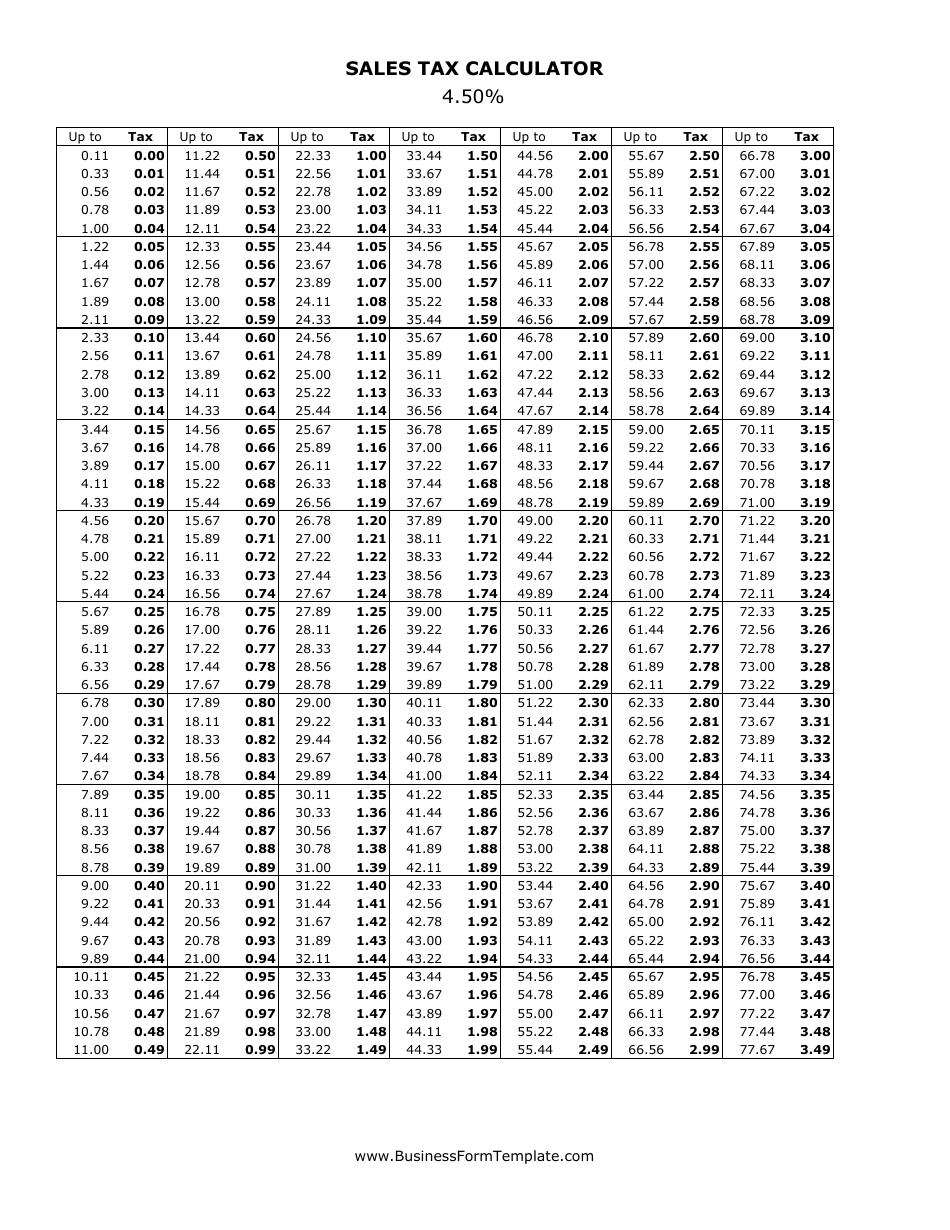

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

Colorado Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

File Sales Tax Online Department Of Revenue Taxation

How S The Market Town Is Buzzing Real Estate Marketing Marketing How To Plan

Winter Park With Highest Sales Tax Rate In The State And Fraser See Increases In Sales Tax Revenue Skyhinews Com

Locating And Discovering Sales Tax Medical Icon Sales Tax Tax

Alpenglow Village On The Horizon Apartment Communities Affordable Housing Village