dependent care fsa limit 2022

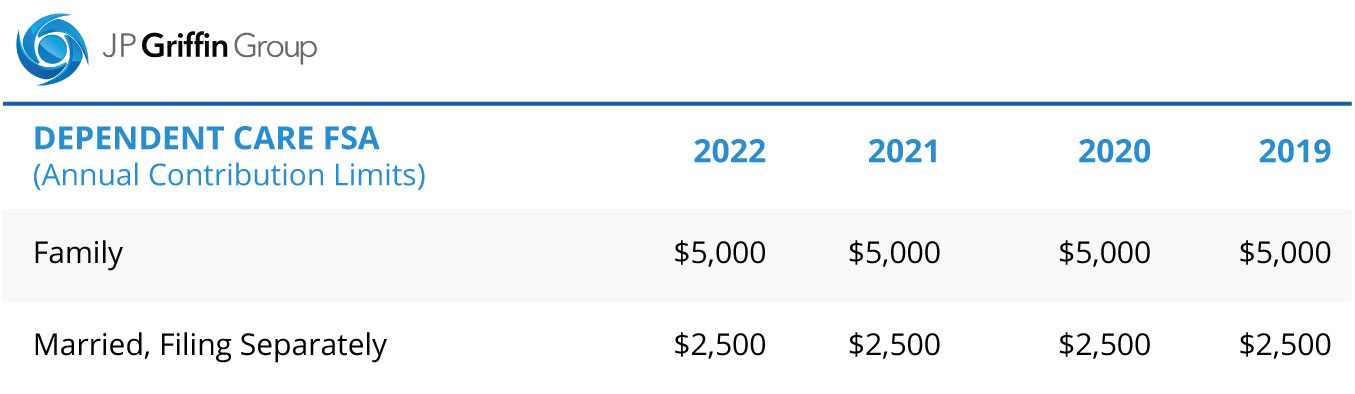

This account can be used for dependent child expenses up to the age of 13. Therefore absent additional congressional action the dependent care fsa limit will revert to 5000 for the 2022 calendar year.

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022.

. The contribution limits for 2022 are. For 2021 the dependent care fsa limit dramatically increased from 5000 to 10500 because of the american rescue plan act of 2021 and that change has not been extended to 2022. Employers may allow a full carry-over of remaining balances for next year up to the total balance in the workers FSA.

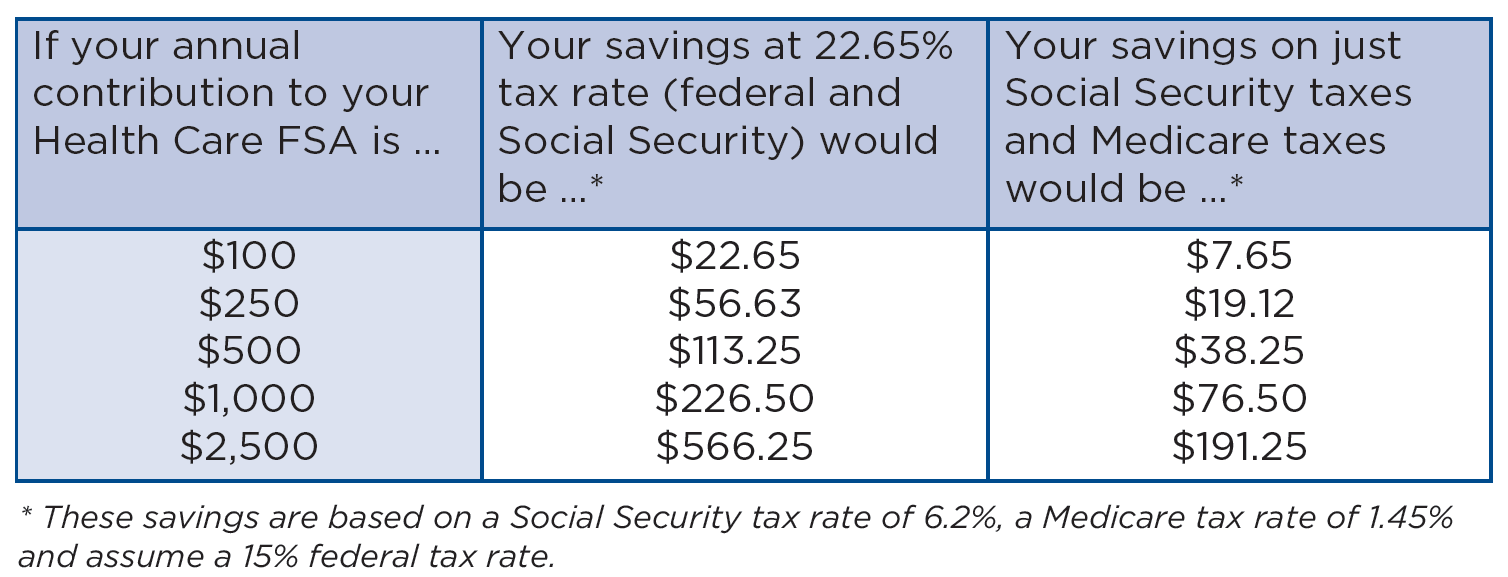

For the 2022 benefit period participants may contribute up to a maximum of 2850 an increase of. Double check your employers policies. Find out if this type of FSA can help you.

For 2022 the maximum amount that can be contributed to a dependent care account is 5000. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. American rescue plan act of 2022 dependent care fsa.

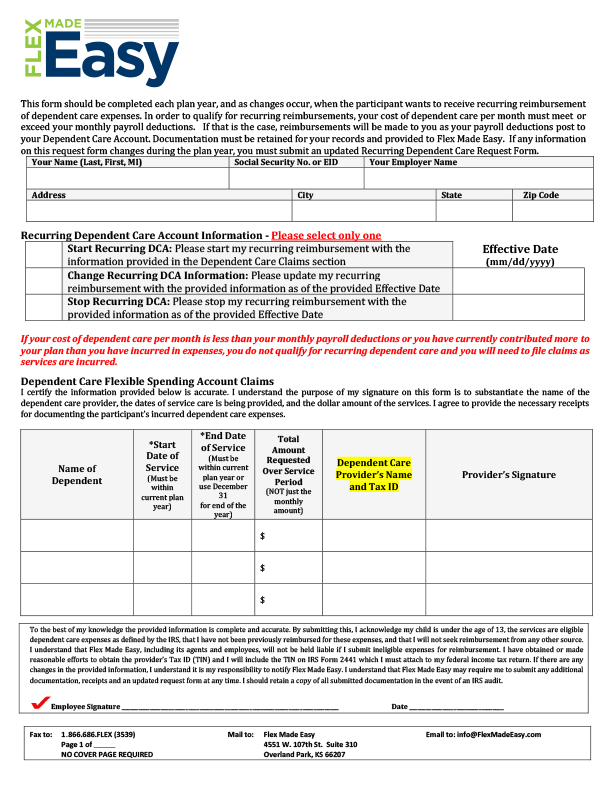

A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible. The annual limits for dependent care assistance program amounts apply to amounts contributed not to amounts reimbursed or available for reimbursement in a particular plan or calendar. Once your child reaches age 13 they are no longer eligible.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021. So if you had. The Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately.

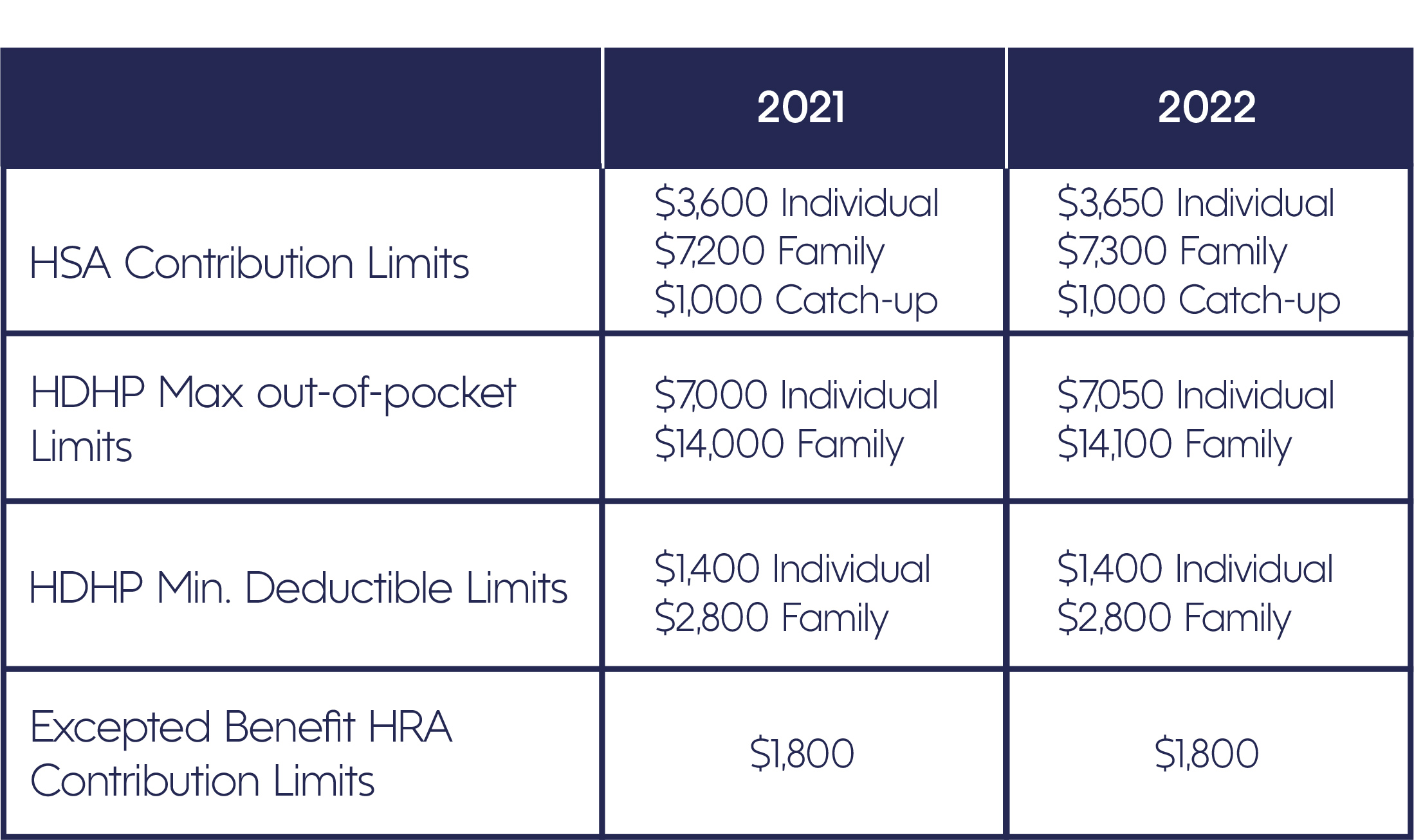

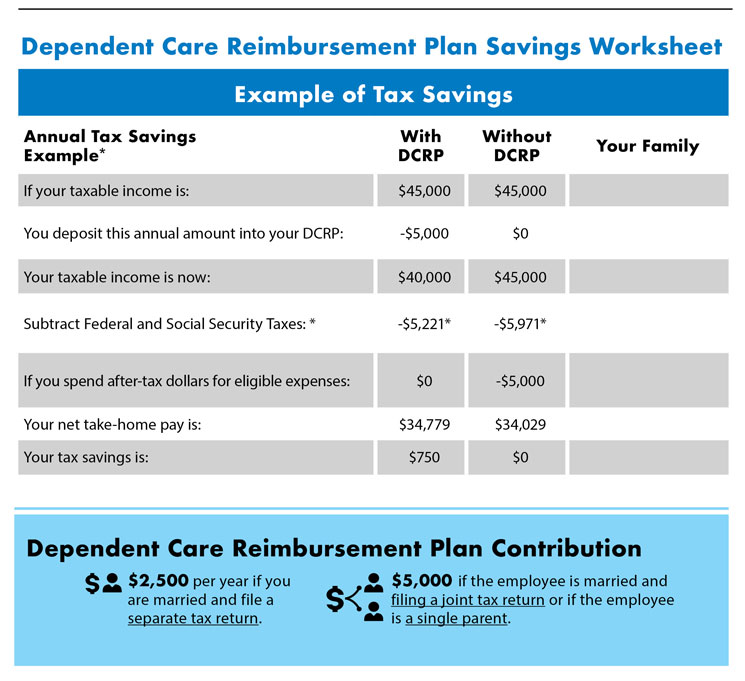

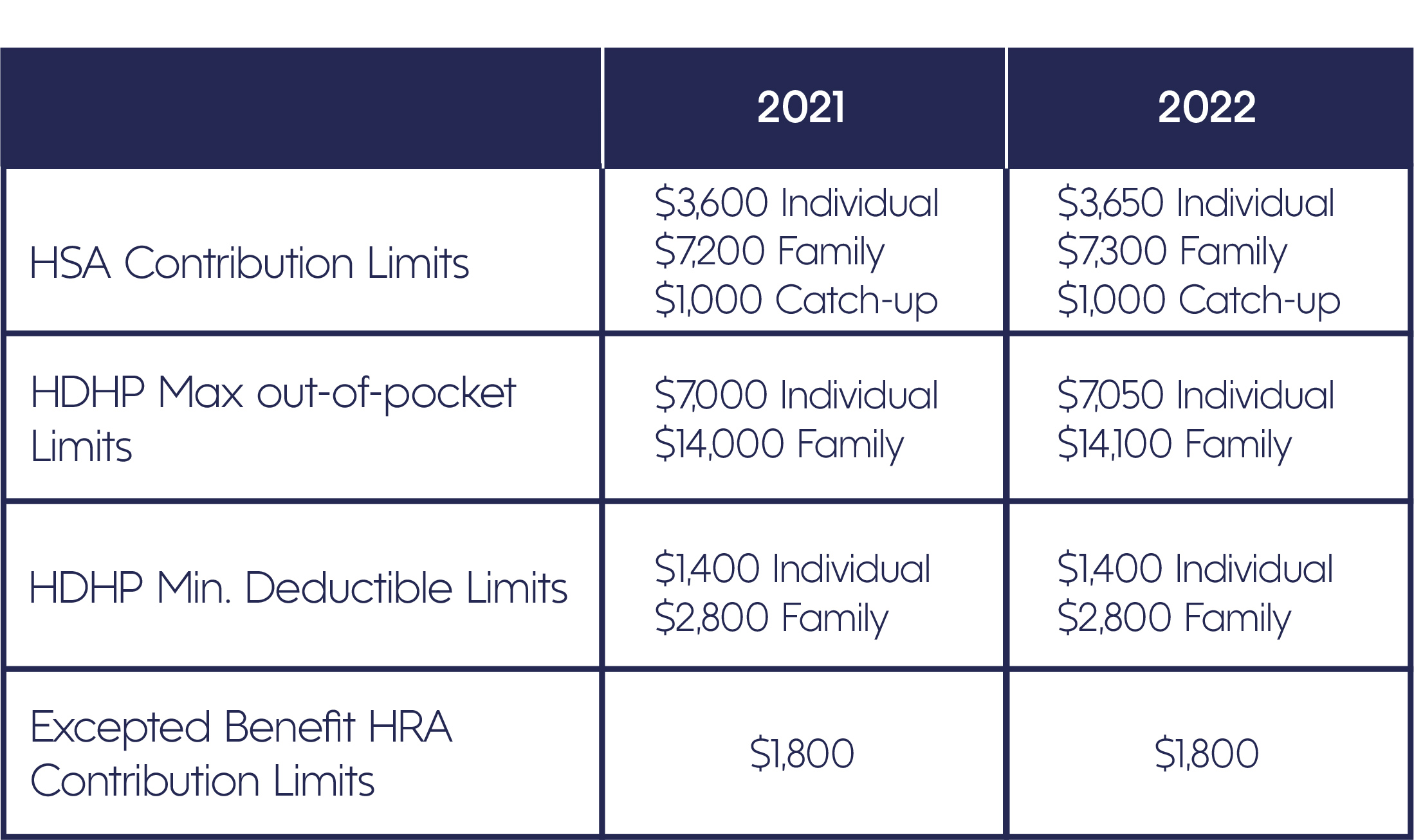

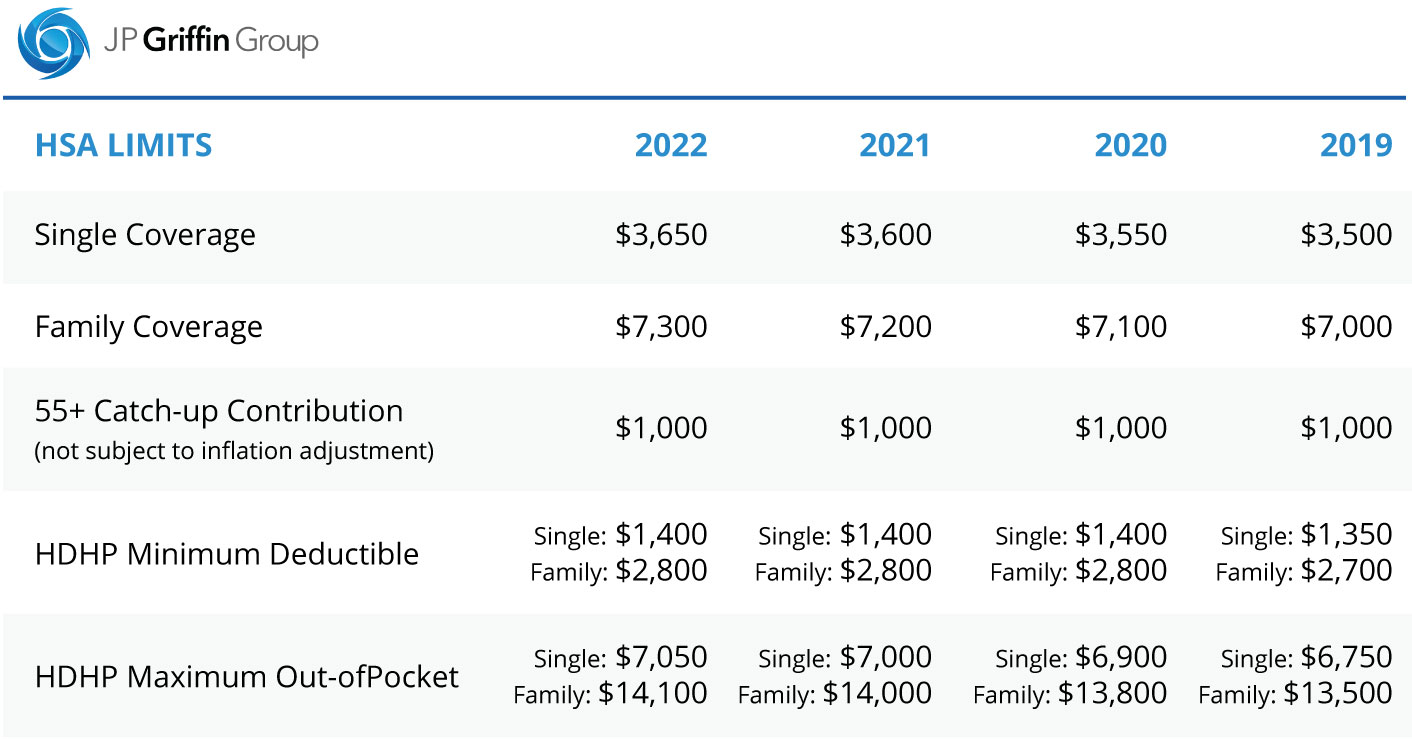

Today we discuss how the dependent care fsa affects the child and dependent care tax credit for 2022. The Dependent Care FSA annual maximum plan contribution limit is 2500 for those married and filing separately and 5000 for those single or married filing jointly. The 2022 family coverage HSA contribution limit increases by 100 to 7300.

The 2021 Dependent Care FSA limits came in response to the COVID-19 pandemic as a temporary relief to working parents. If you and your spouse are divorced only. The minimum annual election for each FSA remains unchanged at 100.

Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses. Employers can choose whether to adopt the increase or not. The carryover limit is an increase of 20 from the 2021 limit 550.

Health and dependent care flexible spending accounts FSAs are employer-sponsored benefit. For dcas the annual contribution limit is 2500 per year if you file your tax return as married filing separately. For 2022 the dependent-care FSA limit returns to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately.

Generally speaking the dependent care fsa contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 usc. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately. To be clear married couples have a combined 5000 limit even if each has access to a separate dependent care FSA through his or her employer.

Employers can also choose to contribute to employees dependent. This account is used to reimburse you for dependent care expenses such as child day care elder care etc. The 2022 family coverage hsa contribution limit increases by 100 to 7300.

As with the standard rules the limit is reduced to half of that amount 5250 for married individuals. The employee receives a total of 8000 in reimbursements for DC FSA benefits during tax year 2022. The HCFSALEXHCFSA carryover limit is 20 percent of the annual contribution limit.

For the 2022 benefit period participants may contribute up to a maximum of 2850 an increase of 100 from the 2021 benefit period. You enroll in or renew your enrollment in your Dependent Care FSA through FSAFEDS during Open Season each year. Dependent Care FSA Increase Guidance.

The employee incurs 2500 in dependent care expenses during the period from July 1 2022 to December 31 2022 and is reimbursed 2500 by the DC FSA. For full details see our prior alert. 125i IRS Revenue Procedure 2020-45.

The carryover limit is an increase of 20 from the 2021 limit 550. How You Get It. In addition the Dependent Care FSA DCFSA maximum annual contribution limit did not change and it remains at 5000 per household or.

Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals. This carryover limit is only for the HCFSA or LEXHCFSA and not allowed for the dependent care flexible spending account DCFSA. Back to main content Back to main content.

ARPA Dependent Care FSA Increase Overview. The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married taxpayers filing separately. If you have a dependent care FSA pay special attention to the limit change.

See more examples Use our Dependent Care FSA Calculator to see how much you can save with a Dependent Care FSA. The 2022 Dependent Care FSA contribution limits decreased from 10500 in 2021 for families and 5250 for married taxpayers filing separately. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500.

5000 per year per household. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. IRS annual contribution limit for 2022.

10 as the annual contribution limit rises to 2850 up from. For 2022 it remains 5000 a year for individuals or married couples filing jointly or 2500 for a married person filing separately. The limit is expected to go back to 5000.

The employee contributes 5000 for DC FSA benefits for the plan year beginning July 1 2022. Your Money Doesnt Roll Over. This means that an employee can set aside 10500 in a dependent care fsa if their employer has one instead of the normal 5000.

2021 plan year into the 2022 plan year 2. For 2022 and beyond the limit will revert to 5000. The Health Care standard or limited FSA rollover maximum limit will increase from 550 to 570 for plan years beginning on or after January 1 2022.

Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

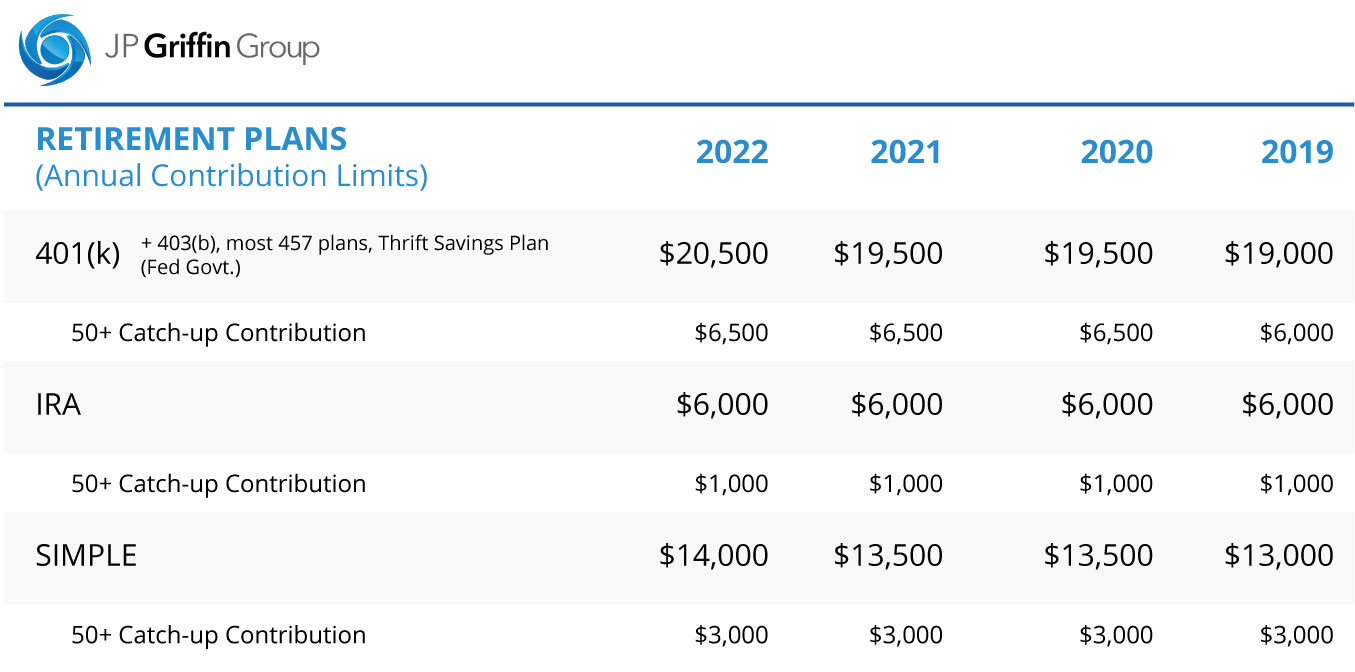

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Coh Dependent Care Reimbursement Plan

2021 Changes To Dcfsa Cdctc White Coat Investor

Dependent Care Flexible Spending Accounts Flex Made Easy

Dependent Care Account American Fidelity

Flex Spending Accounts Hshs Benefits

What Is A Dependent Care Fsa Wex Inc

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

Hsa Dcap Changes For 2022 Blog Medcom Benefits

Why You Should Consider A Dependent Care Fsa

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning