do you have to pay taxes when you sell a car in california

In this case there are two ways to sell a car with a loan Gordon says. Any taxes when you sell a private car.

California To Ban The Sale Of New Gasoline Cars The New York Times

In California the sales tax is 825 percent.

. One to pay off the loan balance to the lender and one. The party who buys the car from you pays the sales tax. Do you have to pay income tax after selling your car.

To take over ownership of a vehicle you will need. When you trade in a vehicle instead of paying tax on the full value of the new car you are taxed based on the difference in value between the trade-in and the new vehicle. When it comes time to calculate your total income to report on your 1040 form you need to include all the money.

This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease. If your trade-in is. In California for example if I sold you a used car for 10K you would pay a sales tax on it about 1K.

One method is to have the buyer give you two checks. If youre selling a car for less than you paid for it you will not have to pay taxes on it. You dont have to pay any taxes when you sell a private car.

You must report the ownership transfer to the California DMV within 10 days of the sale date. Do i pay tax when i sell my car in California Expube. So if you live in a state with a.

The vehicles title sometimes referred to as a pink slip signed by the person selling the car. If your car is a collectible and has appreciated in value you are subject to capital gains tax on the profit. Is it better to gift a car or sell it for 1 in California.

While some car owners. Even in the unlikely event that you sell your private car for more. Their signature is required on Line 1 of the.

According to Carbrain you may or may not have to pay taxes when you give or receive a car as a gift. 5 hours ago You dont have to pay. Either mail in a completed Notice of Transfer and Release of Liability Form REG 138 or notify.

Ad Heres our guide to the most common car buying mistakes and how you can avoid them. Is it better to gift or sell a car in California. Under California law youre not required to pay use tax on a vehicle you receive as a gift.

Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and. This is because you did not actually generate any income from the sale of the vehicle. If you took that same car and sold it back to me for 10K the state would require me to.

You dont have to pay any taxes when you sell a private car. The DMV has a gift process for a. Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and.

Buying a new or used car is a big decision.

California Vehicle Fees Tax Title License Renewal Novato Toyota

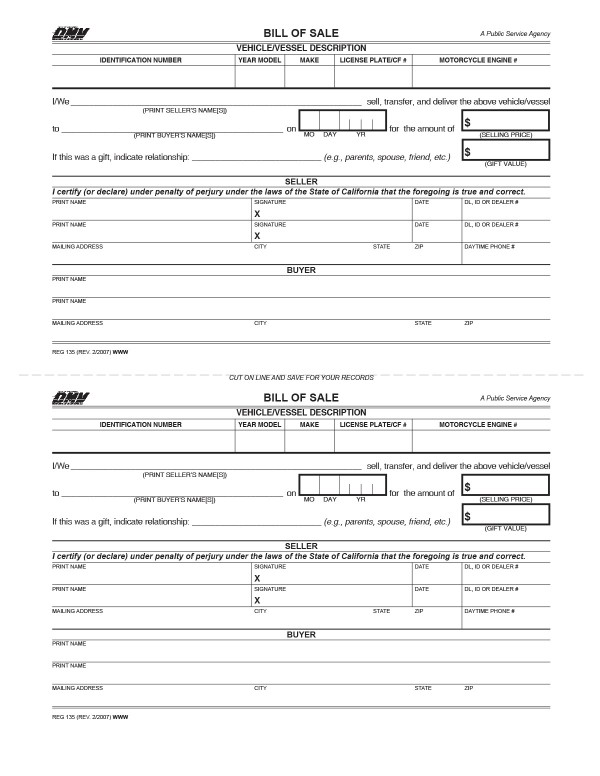

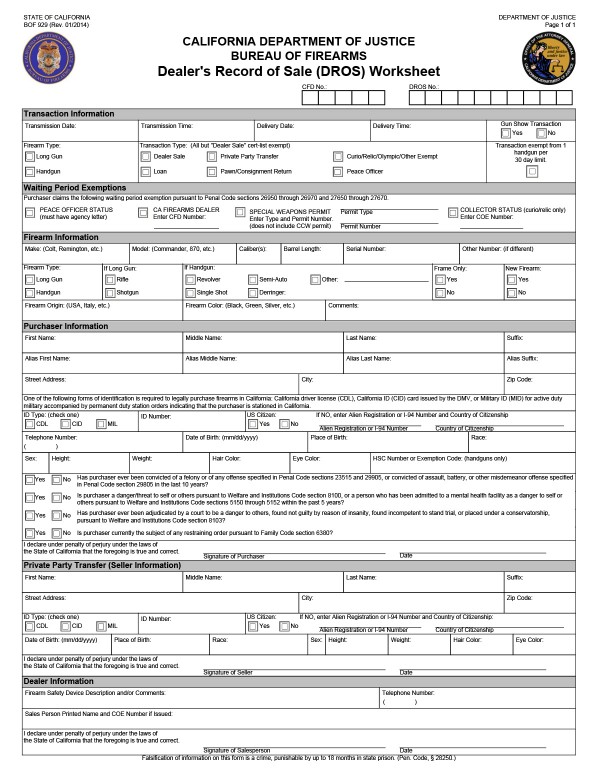

All About Bills Of Sale In California The Facts And Forms You Need

States With The Highest Lowest Tax Rates

California Unveils Proposed Rule To Ban New Gas Fueled Cars Calmatters

Do You Pay Sales Tax On A Used Car Nerdwallet

All About Bills Of Sale In California The Facts And Forms You Need

Free Motor Vehicle Dmv Bill Of Sale Form Word Pdf Eforms

What S The Car Sales Tax In Each State Find The Best Car Price

All About Bills Of Sale In California The Facts And Forms You Need

California Vehicle Tax Everything You Need To Know

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

How To Register Your Out Of State Vehicle In California

Here S Why So Many Exotic Cars Have Montana License Plates Autotrader

When I Sell My Car Do I Have To Pay Taxes Carvio

What You Need To Know About California Sales Tax Smartasset

California Vehicle Sales Tax Fees Calculator

Here Are The Challenges Ahead For California S Ban On Gas Cars The New York Times